Understanding OSFI's Proposed Changes to Mortgage Lending Rules

Have you heard about the buzz surrounding the new proposed rules by OSFI (Office of The Superintendent of Financial Institutions)? If not, let me break it down for you.

On March 22, 2024, it was confirmed that in the first quarter of 2025, OSFI will implement new criteria for banks regarding their Loan-to-Income (LTI) percentage. Currently set at 7.5% for the five major banks, this percentage represents the total amount of loans a bank issues annually relative to its portfolio. In simpler terms, for every dollar of annual income, the bank is comfortable lending out $7.5. Let's illustrate this with examples:

- Client A has a household income of $200,000. So, 200,000 x 7.5 = $1,500,000. With a $1.5M loan, buying a nice home is within reach.

- Client B has a household income of $65,000. Thus, 65,000 x 7.5 = $487,500. This amount could buy a decent starter condo or home, depending on the city.

However, the new rules proposed by OSFI are set to cap this LTI percentage at 4.5%, a significant decrease from the current rate. Moreover, this rule will specifically apply to uninsured loans, primarily affecting properties valued over $1 million. Let's revisit the examples:

- Client A's loan capacity now reduces to $900,000 (200,000 x 4.5), which might mean considering a smaller property.

- Client B's loan potential decreases to $292,500 (65,000 x 4.5), limiting options even further.

But why is OSFI making these changes? Essentially, they aim to prevent banks from accumulating too many high-risk loans, especially in anticipation of a potential increase in real estate prices when interest rates decrease. By implementing stricter criteria, OSFI hopes to mitigate the risk of defaults, which could significantly impact banks' financial stability.

Financial experts suggest that while these changes may not directly affect individual borrowers, they could impact the overall banking system. As long as banks can maintain a balanced portfolio, the system should remain stable.

However, the repercussions could be significant for both buyers and sellers. With smaller buyer pools, purchasing power diminishes, potentially affecting property prices. Sellers may find their pool of prospective buyers shrinking, potentially impacting their property's market value.

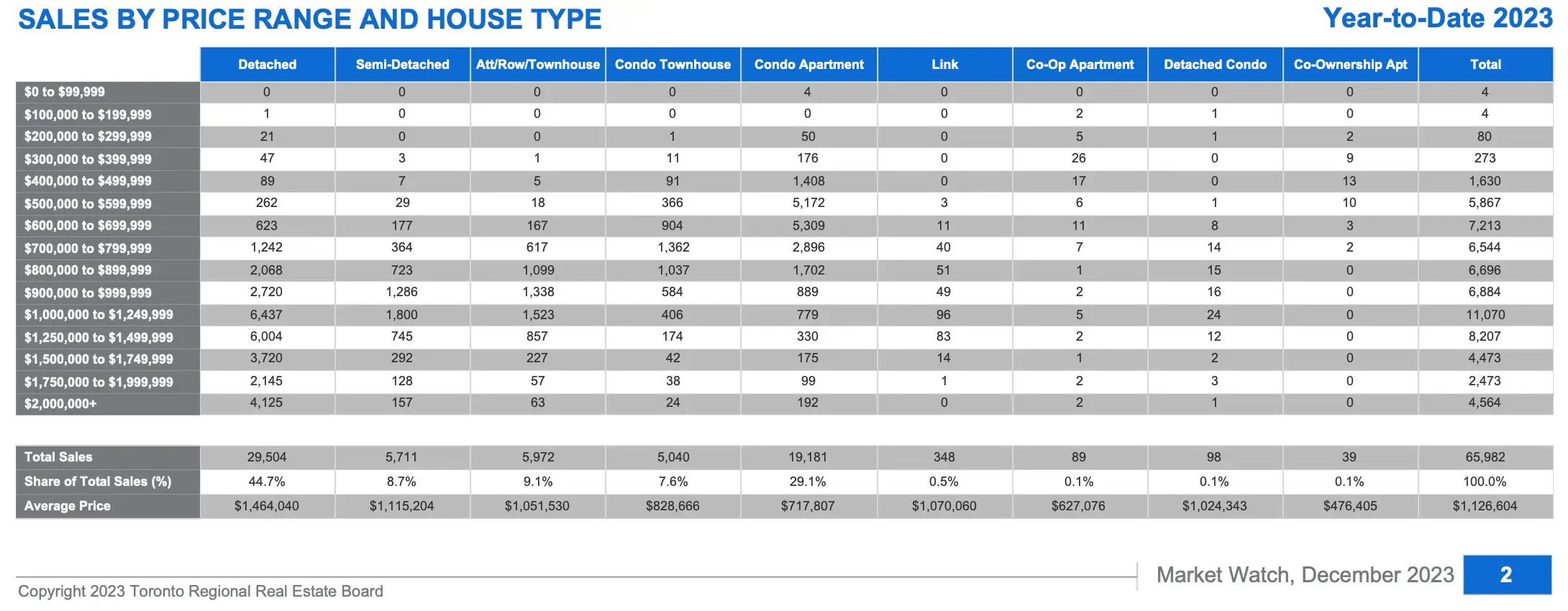

Analyzing data from the Toronto Regional Real Estate Board (TRREB) from 2023, which saw a 13% decline in sales compared to the previous year, we can see that the majority of sales fall within the $1M-$1.5M range for detached homes and $500k-$1M for condos. These segments will be significantly affected by the new rules.

73.8% of sales transactions in the TRREB board last year were in detached homes and condo apt resales, so let’s work with that.

As we can see from the graphs below, the vast majority of sales were between $1M-$1.5M for detached homes and $500k-$1M for condos, with 12,441 and 15,968 units sold, respectively.

Here's where it gets interesting: Remember when I mentioned that the 4.5% portfolio cap only applies to uninsured loans? Everyone in the above-a-million-dollar bracket will feel the impact, whereas condo owners can breathe a little easier—unless they're looking to sell their condo to buy a larger property. In that case, they might find themselves unable to afford the upgrade due to stricter lending rules the banks must follow. As for those with detached homes, it's safe to assume that their buyer pool, which typically multiplies by 3-5 available buyers for every home sold, just decreased by 25-30%.

In conclusion, while the exact impact remains uncertain, it's essential for both buyers and sellers to consider these proposed changes carefully. Whether to sell now or wait could make a substantial difference in property value and market demand.

If you are interested in understanding how these changes could affect your property's value or your next move in the market, feel free to reach out anytime.