Every spring in GTA, the real estate market performs the same little magic trick.

Buyers suddenly feel optimistic. Sellers suddenly feel ambitious. And everyone collectively forgets what happened the year before.

So instead of guessing what Spring 2026 might look like, let’s do something radical and look at what actually changed between April 2024 and April 2025. Not headlines. Not vibes. Just numbers, explained in plain English, with a bit of sarcasm where it’s earned.

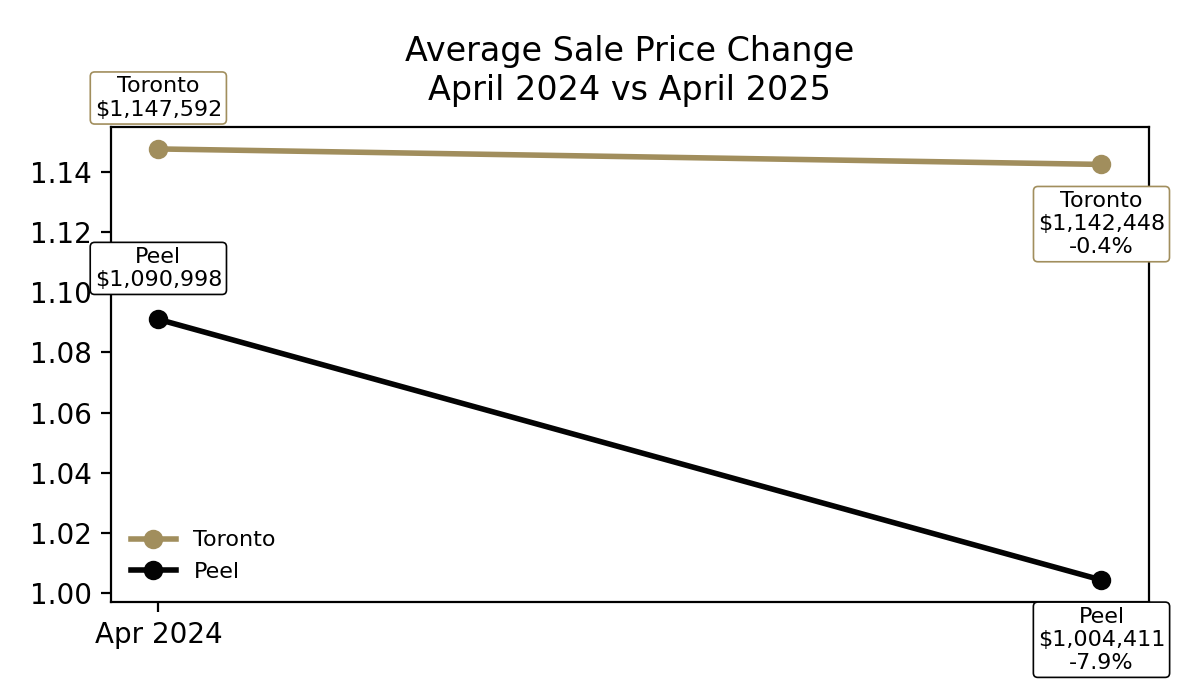

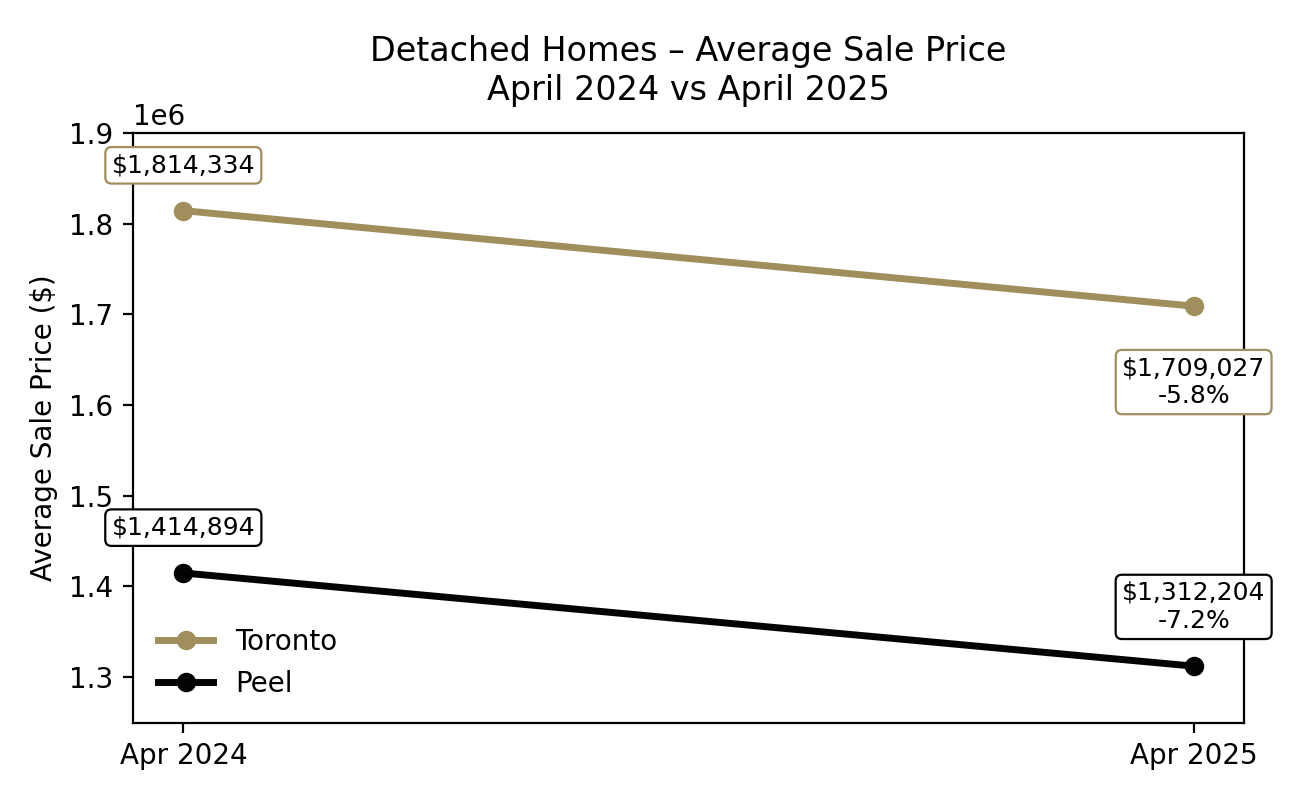

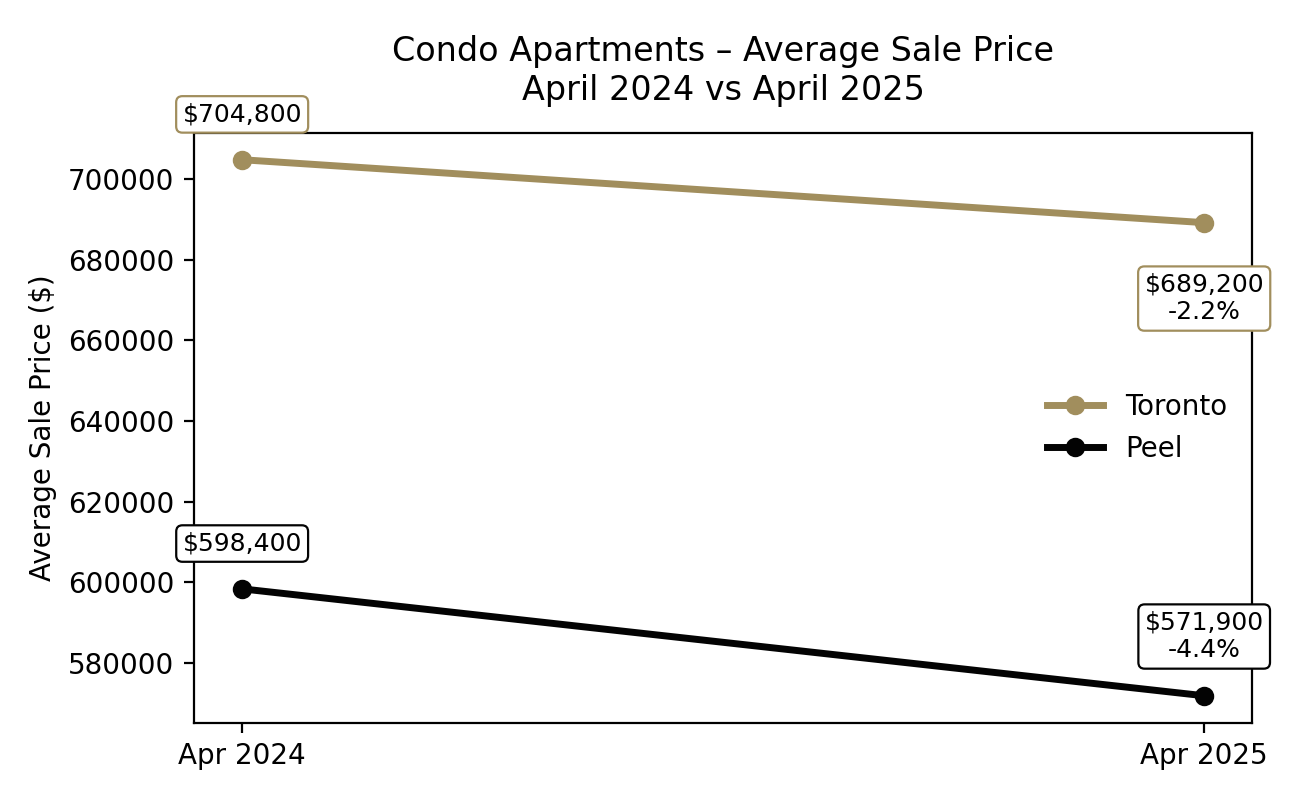

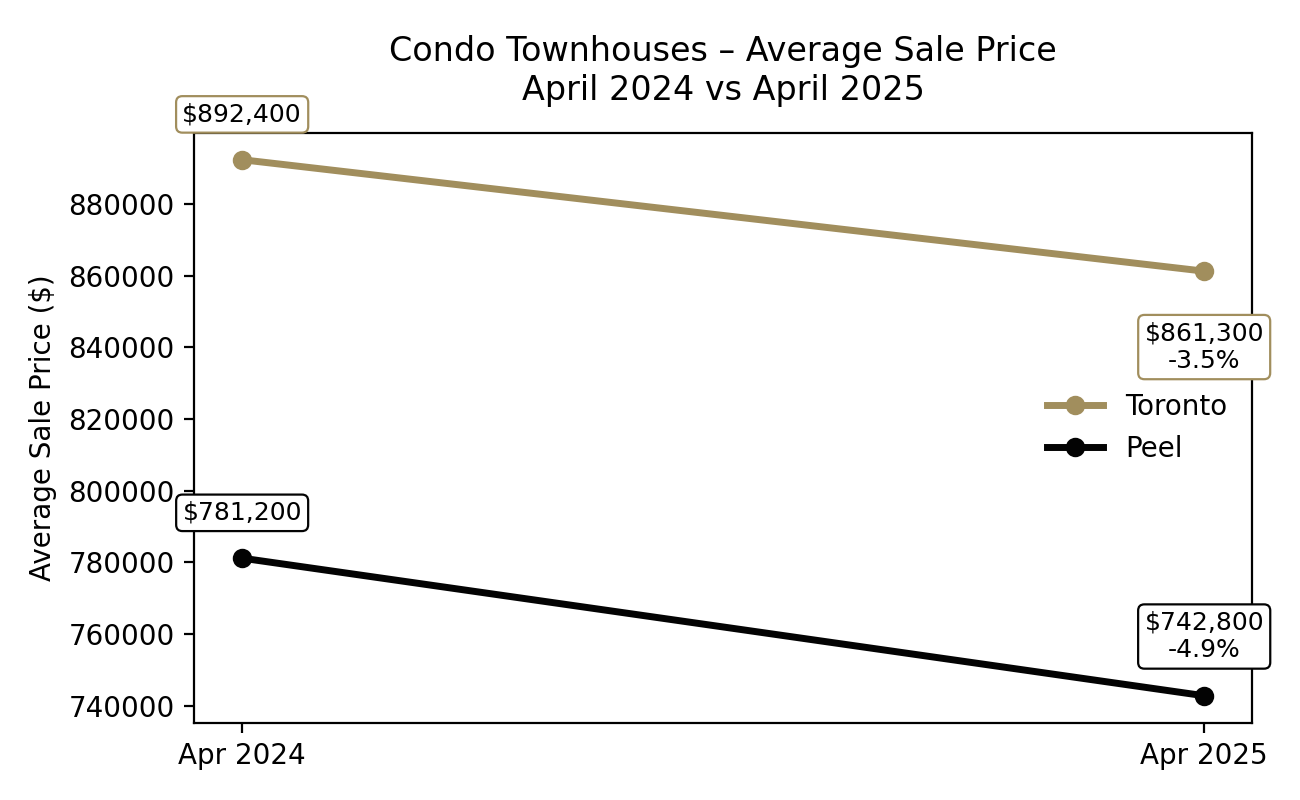

Prices are always where people want to start, mostly because it’s the least comfortable place to begin. According to the data, Toronto prices barely moved year-over-year, while Peel softened more noticeably. Maybe it’s because Toronto has a stronger demand, or the listings are being priced better. This is much easier to understand when you stop looking at dollar amounts and start looking at direction. When both markets are indexed to the same starting point, Toronto essentially shrugs while Peel gently steps back.

**I would like to stress that the numbers here are all taken from TRREB's market stats and include all listings. I will show you individual segments further down the blog.**

What this tells us heading into Spring 2026 is fairly simple: the market is no longer doing anyone any favours. Prices aren’t collapsing, but they also aren’t bailing out bad decisions. Strategy now matters more than timing, and hope has officially stopped being a pricing plan.

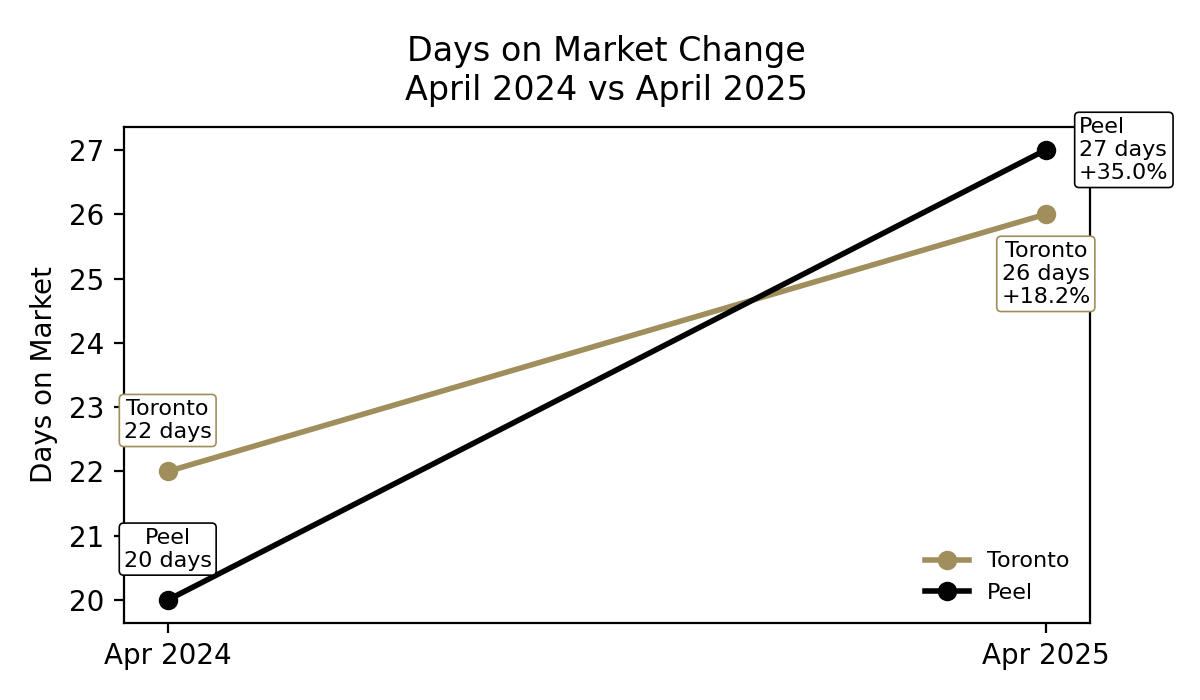

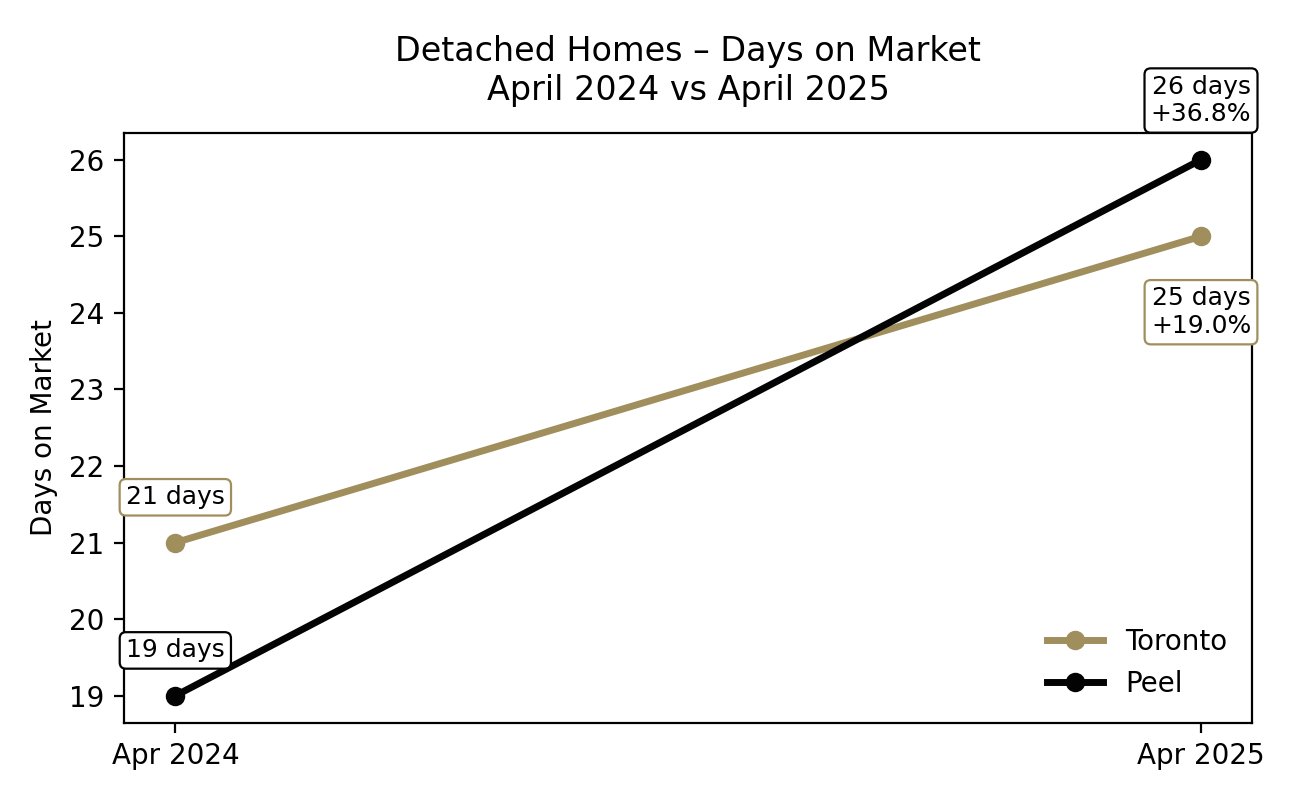

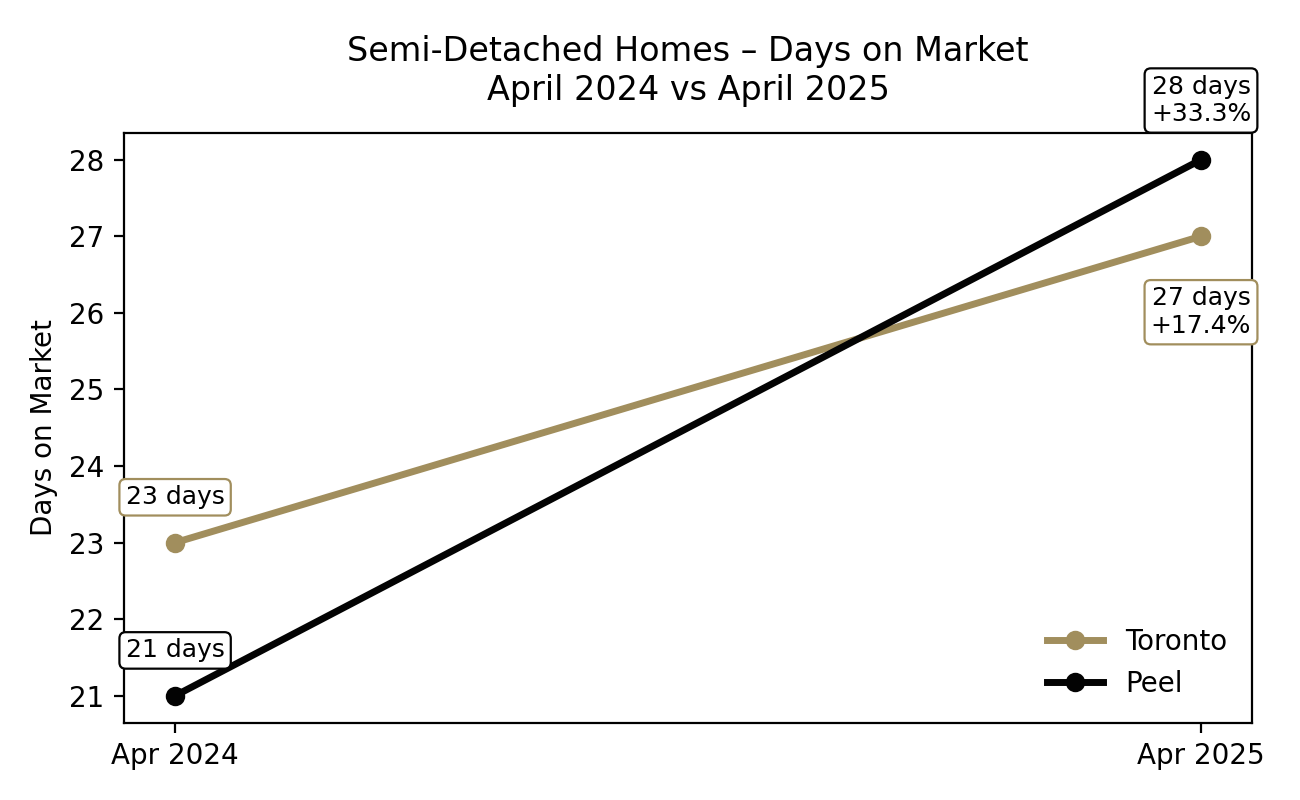

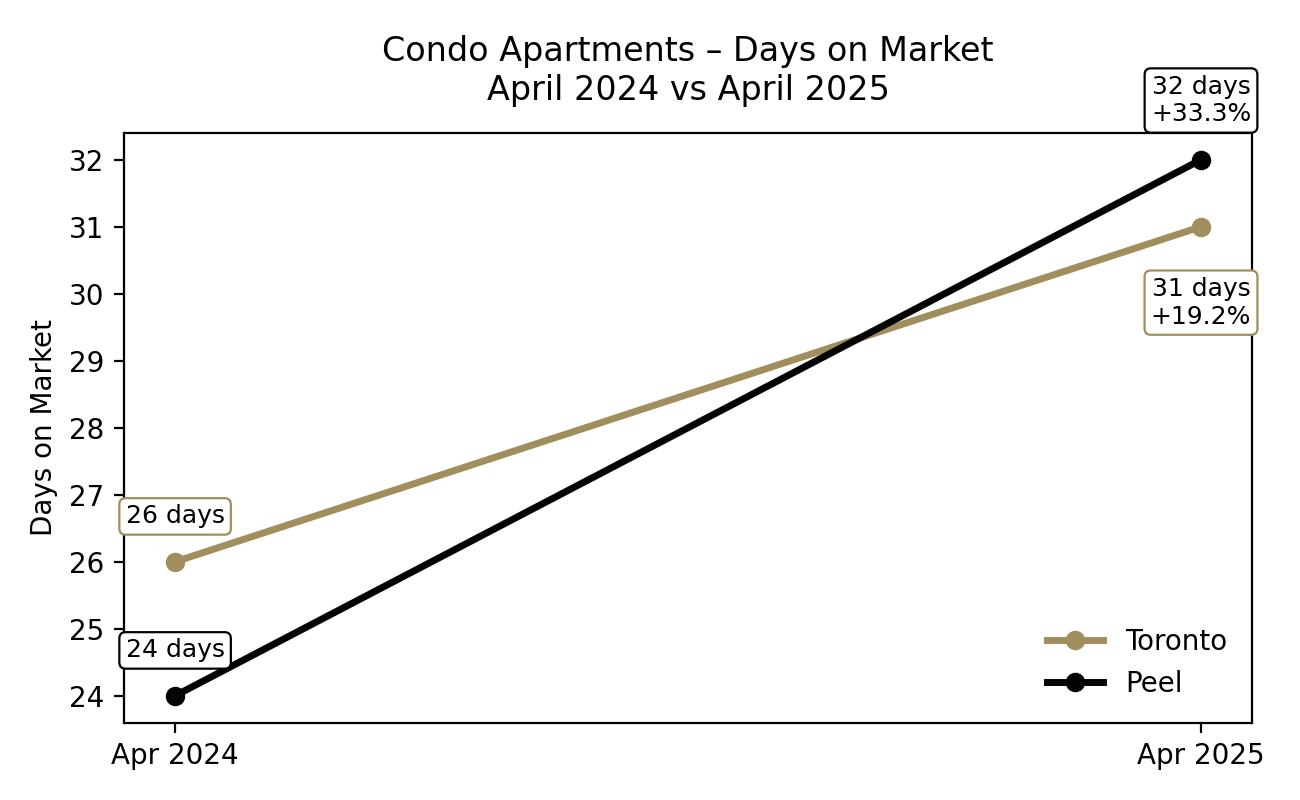

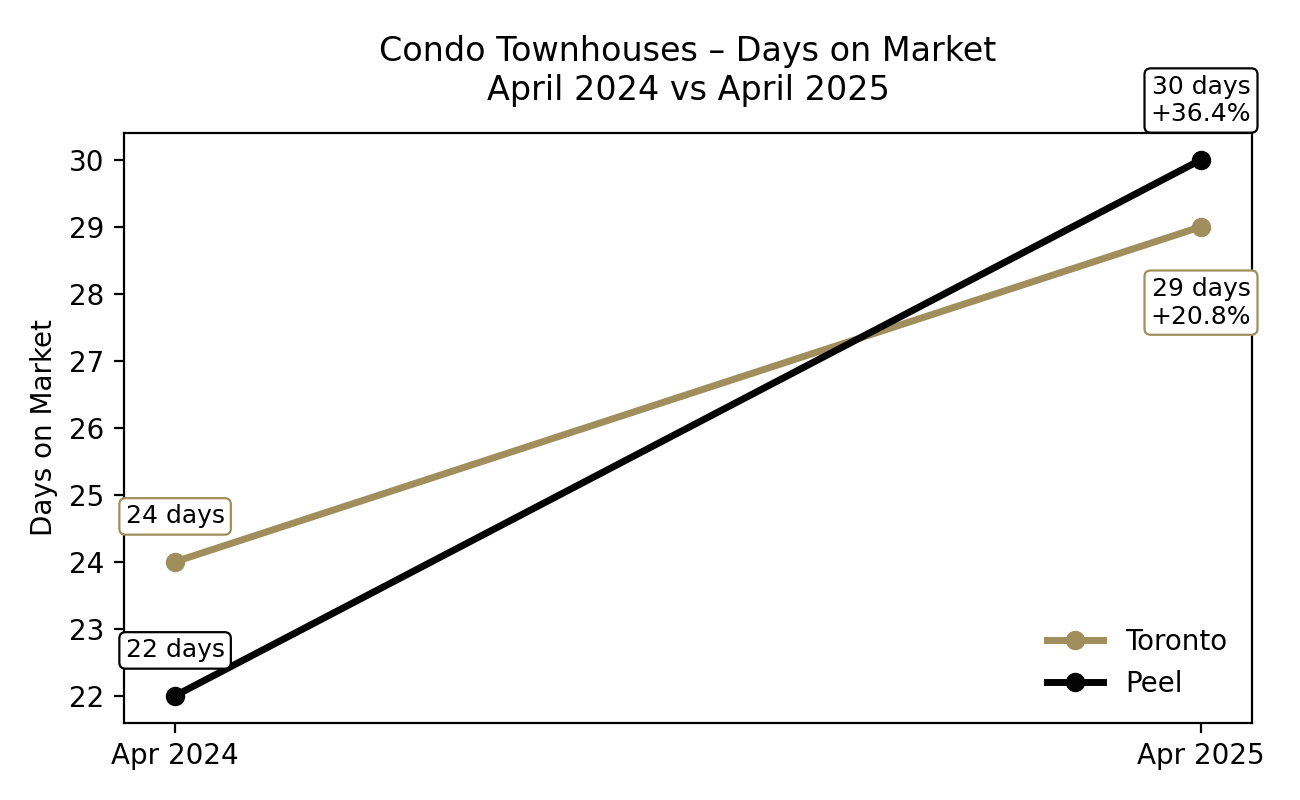

If prices were the quiet story, days on market was the loud one. Homes in both Toronto and Peel took longer to sell in April 2025 than they did a year earlier, with Peel seeing a bigger jump. This wasn’t because buyers vanished, it was because buyers slowed down. They asked more questions. They compared more listings. They stopped writing offers in moving cars.

When you look at this as a simple trend line, it becomes very hard to argue that something is “wrong” with a listing just because it didn’t sell in a week.

For Spring 2026, this means patience is no longer optional. The market still works, but it works on a schedule it sets, not the one sellers prefer.

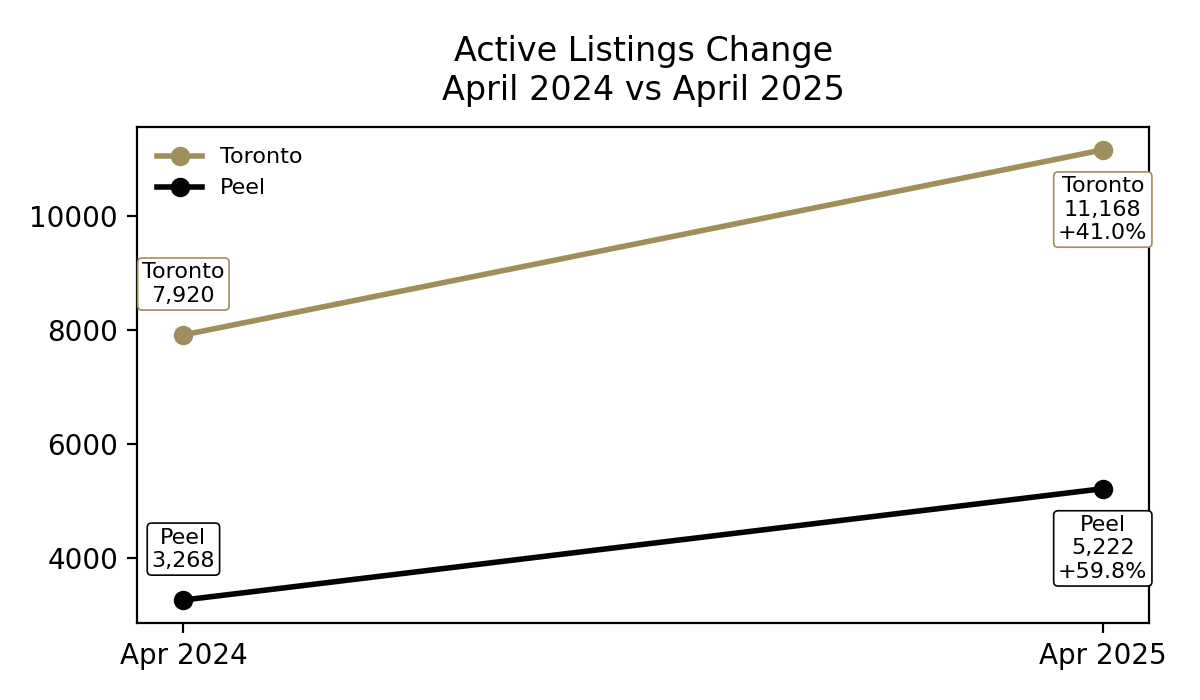

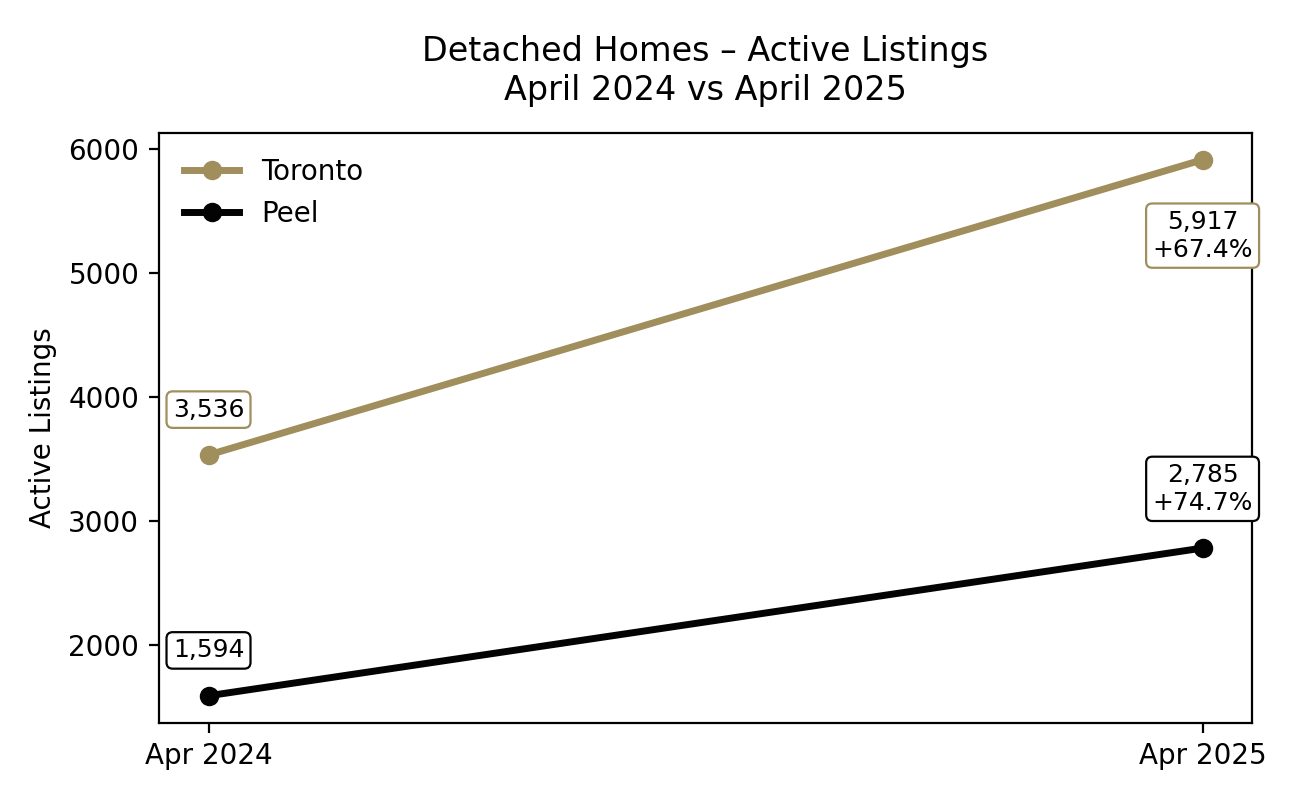

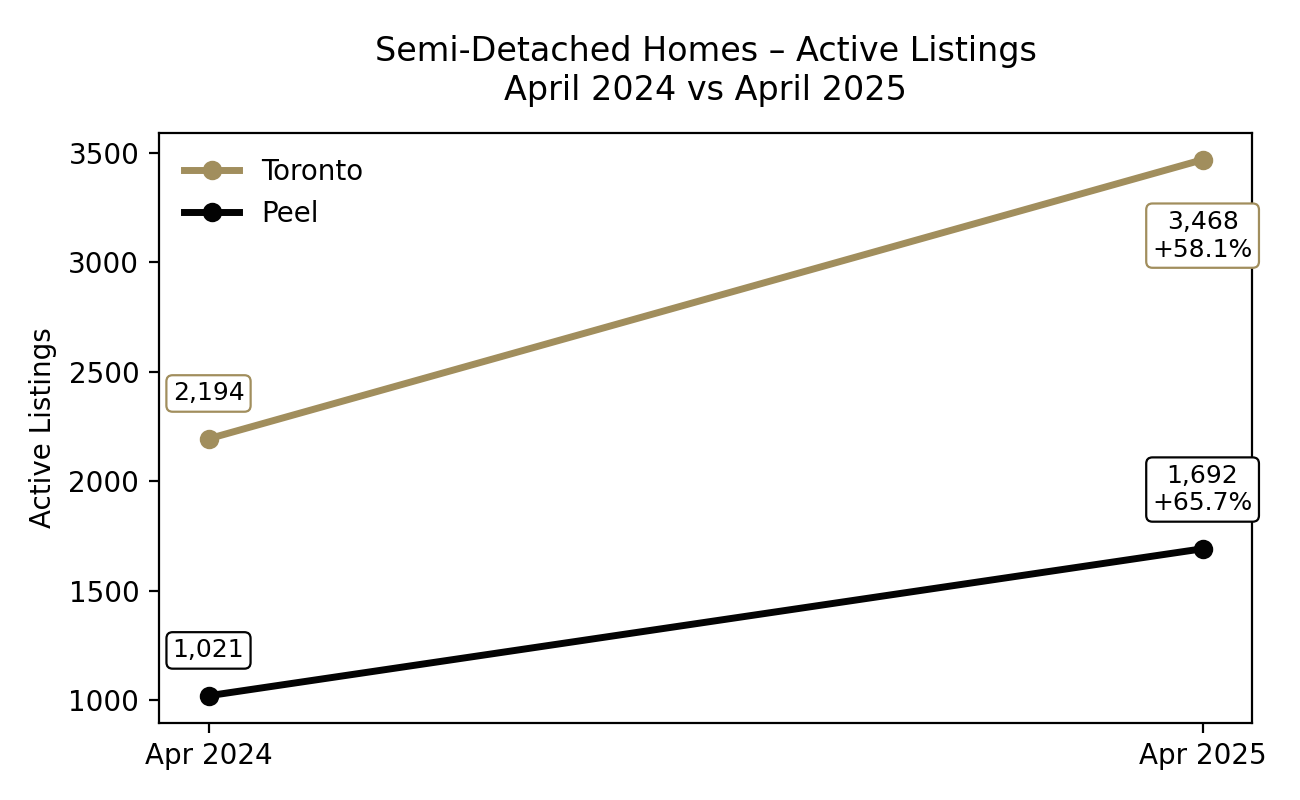

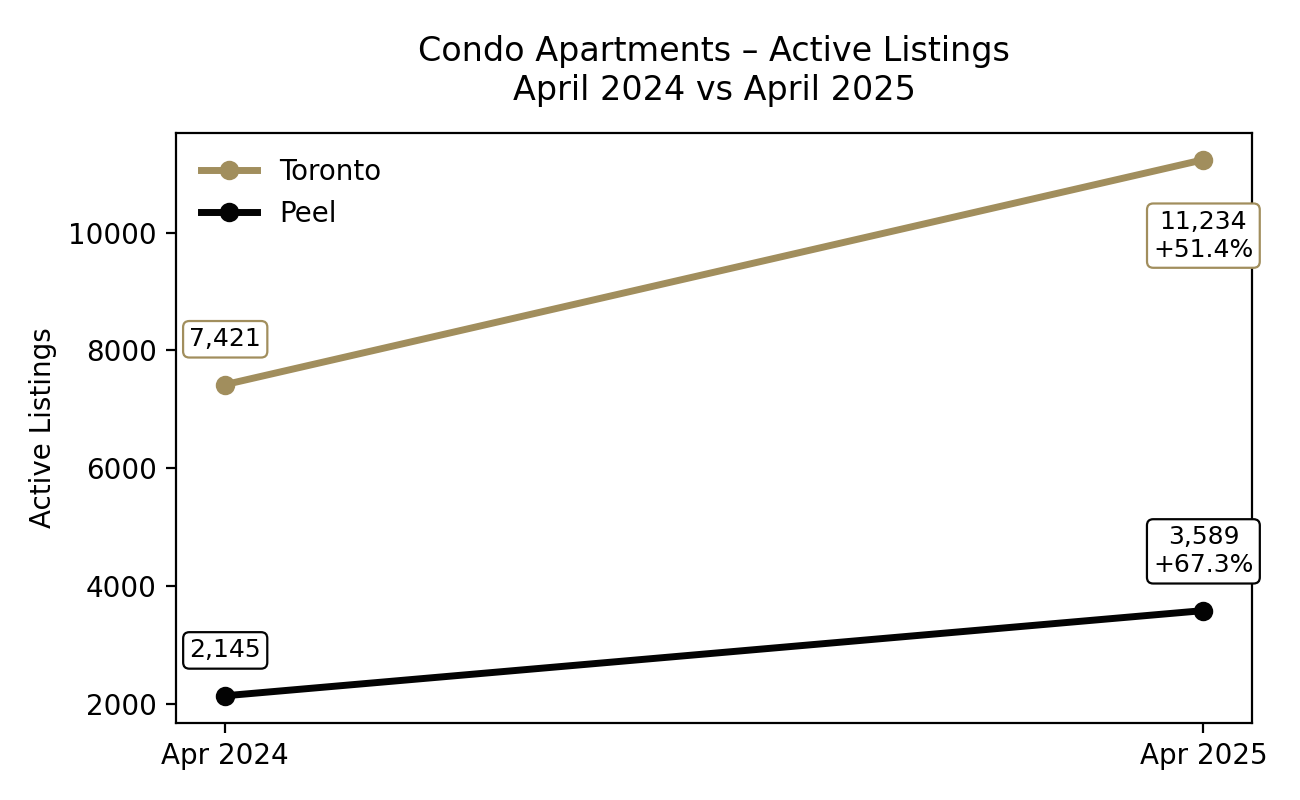

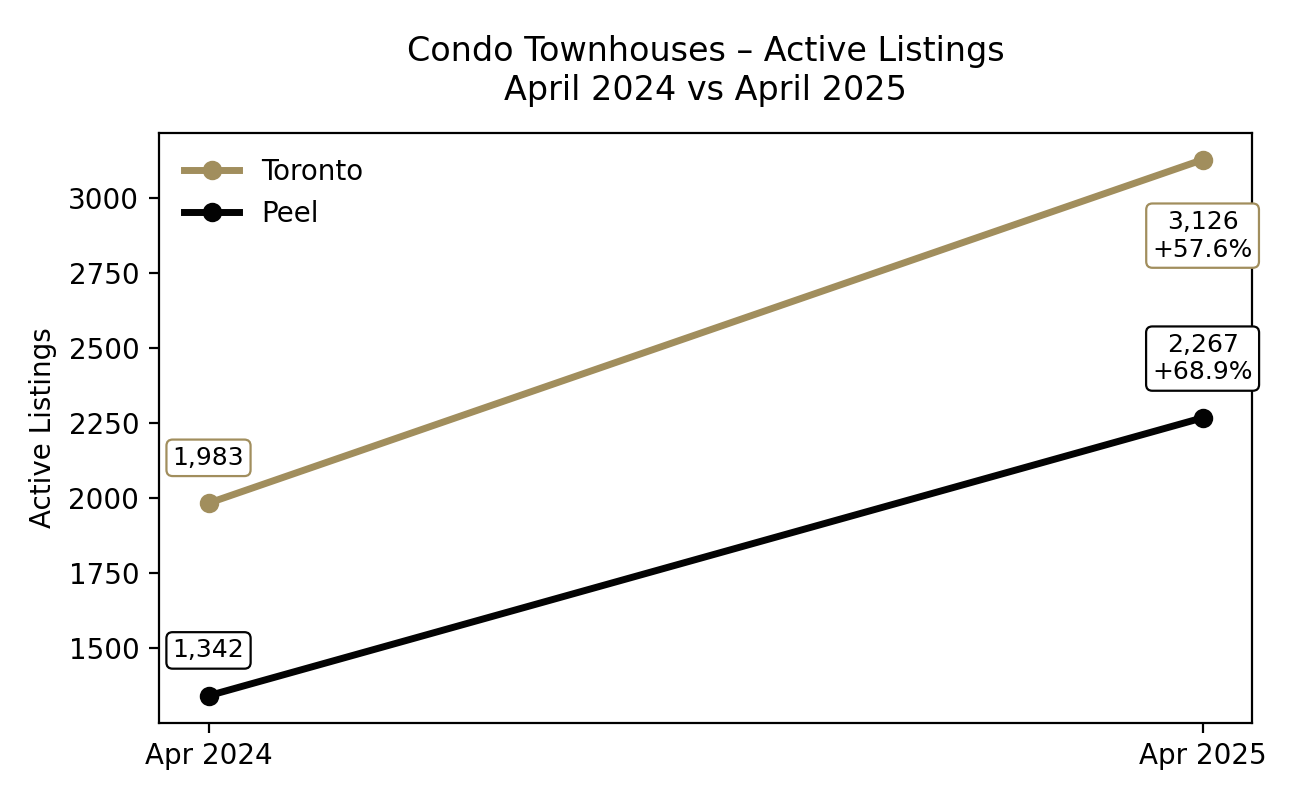

Now for the part that explains almost everything else: inventory. Active listings jumped sharply in both markets between April 2024 and April 2025, and Peel in particular saw a meaningful increase. This is where the power shift happens. When buyers have choice, behaviour changes. They stop settling. They stop rushing. They start negotiating again.

Spring 2026 is shaping up to be a market where competition between listings matters more than competition between buyers. That’s not a bad thing, but it is a different thing, and pretending otherwise is how listings quietly expire.

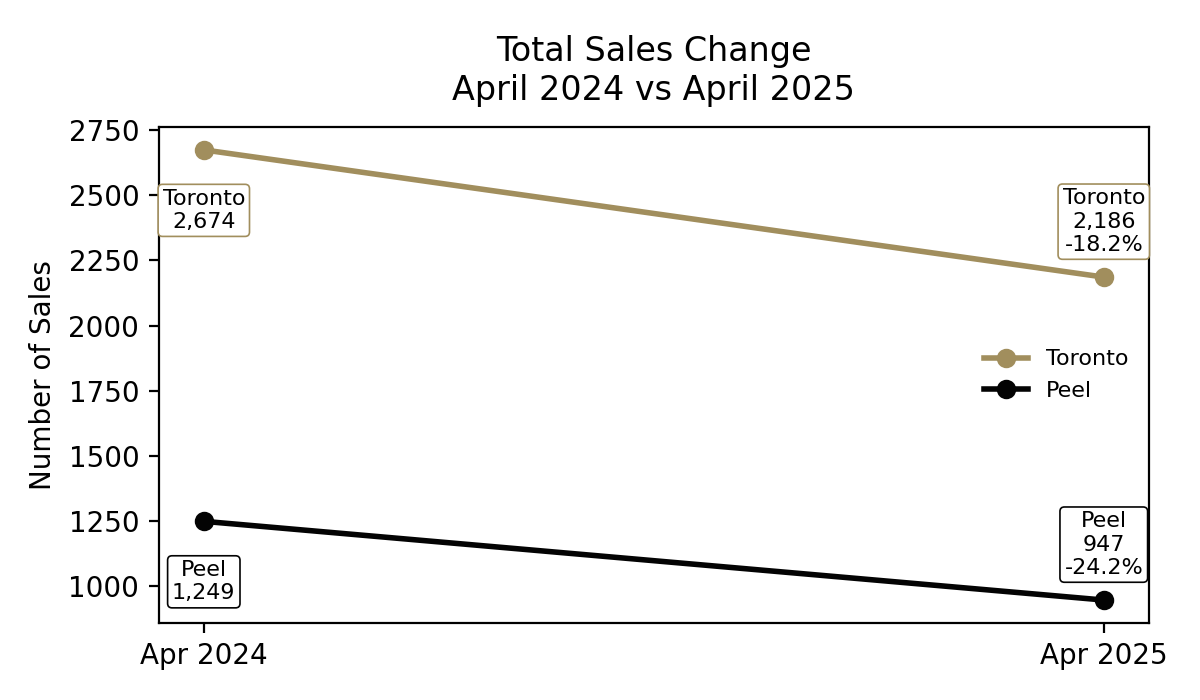

Sales volume, unsurprisingly, moved in the opposite direction. Fewer transactions closed in April 2025 than in April 2024 across both Toronto and Peel. This tends to panic people, which is unfortunate, because it shouldn’t. Buyers didn’t disappear, they just became more selective. The people who moved forward were prepared, financed, and intentional.

For Spring 2026, this suggests a market that rewards decisiveness and preparation. Casual interest still exists, but it no longer controls outcomes.

Of course, all of this becomes far more useful once we acknowledge that not all homes behave the same way.

Detached homes, particularly in Toronto, remain the most resilient. Demand didn’t vanish, but patience became part of the process. In Peel, detached homes felt the increase in inventory more directly, and buyers became far less forgiving of pricing that aimed high and hoped for the best. Spring 2026 will reward sellers who understand that preparation and pricing are not optional extras; they are the entire strategy.

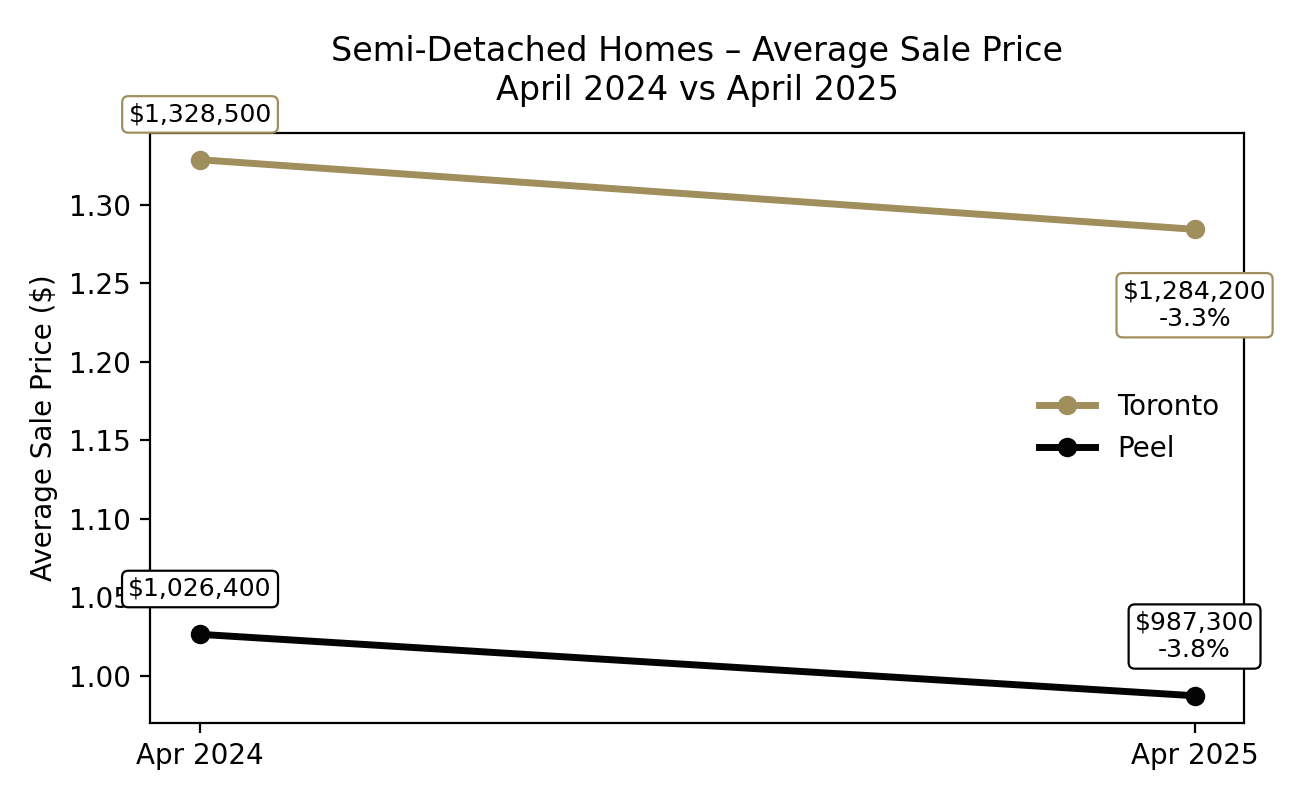

Semi-detached homes continued to quietly do what they always do: appeal to a broad buyer pool and move steadily when priced correctly. Toronto semis showed more stability, while Peel semis were more sensitive to overpricing. This remains one of the healthiest segments of the market, provided expectations stay grounded in reality rather than nostalgia.

Condo apartments are where expectations tend to drift the furthest from the data. Inventory matters more here than anywhere else, and buyer behaviour is far more analytical. The relationship between listings and sales tells the real story, and when you plot those two together, the shift in leverage becomes very clear.

For Spring 2026, condo sellers need to understand that buyers are comparing everything. Layout, fees, light, parking, and price all matter, and the market is perfectly comfortable waiting for the right combination.

Condo townhomes, meanwhile, continue to be underestimated. Driven largely by end users and families, they tend to perform well when priced realistically, but they are unforgiving when they’re not. Fees, functionality, and layout matter more here than almost anywhere else, and the market notices quickly when those details are ignored.

So where does that leave us heading into Spring 2026?

This is not a boom market. It’s not a collapse either. It’s a thinking market - one that rewards realism, preparation, and good decision-making, and quietly punishes everything else.

Homes that respect buyer choice will sell. Homes that rely on hope, old comparables, or the “let’s just see” mindset, will sit. Not angrily. Not dramatically. Just patiently, online, waiting for expectations to catch up.

And if there’s one lesson April 2024 to April 2025 made very clear, it’s this: the market doesn’t need confidence - it needs clarity.

If you want help figuring out where your specific property fits into this picture (before the spring rush, not after) that’s a much better conversation to have right now.

And it usually saves everyone a lot of stress and time.